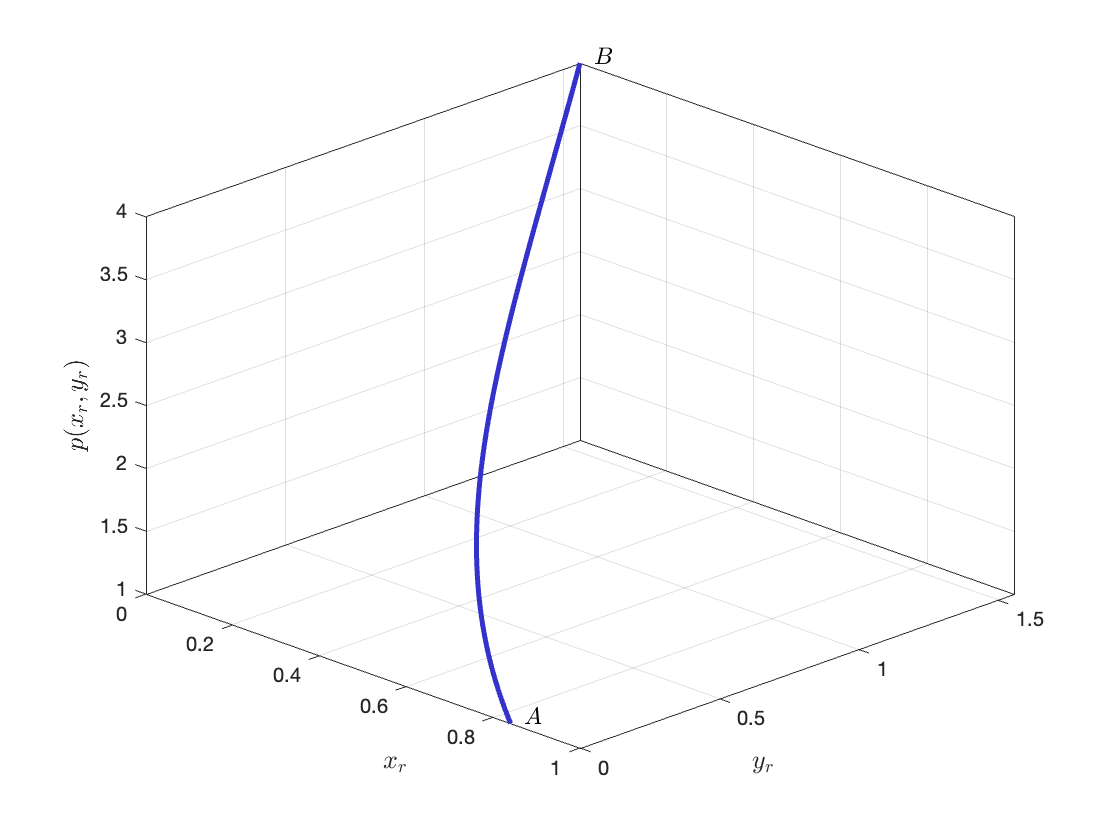

Figure 1: Reserves and spot prices on liquidity concentrated sections derived from new conservation functions developed in the framework described on this page.

Automatic Market Makers (AMM) are mechanisms that enable the exchange of assets through algorithms governing price formation and the allocation of liquidity. At their core lies a conservation function, a mathematical invariant under trading that constrains every exchange to preserve a functional relationship among the quantities and proportions of the assets involved. The primary application of this framework so far is found in liquidity pools, decentralized architectures conceived as alternatives to centralized exchanges.

This page, in progress, contains summary descriptions of a framework I have developed to redefine liquidity design across asset classes through a new family of conservation functions that expand the limited scope of existing formulations, allowing for richer liquidity and volatility dynamics and offering a configurable spectrum of profiles with myriads of potential applications.

Technically, examples of new mechanisms include:

- Support of systems with both coin substitutability and complementarity;

- Concentrated-liquidity designs that support price-bounded reserve allocations, extending well beyond the initial attempts made by Uniswap (e.g. with its “v.3”);

- Multi-curve routers that optimally distribute trade flow across heterogeneous pools, thereby reducing slippage through endogenous routing;

- Convex blends of conservation functions with adaptive curvature, offering sharper reversion to parity in stablecoin architectures; and

- Non-homothetic formulations that generalize beyond proportional liquidity scaling.